Stock markets globally have lost over $6 trillion dollars since the start of the Coronavirus pandemic, the largest losses since the financial crisis over a decade ago. With economic uncertainty, recession, or talk of war the price of gold, unlike stocks and shares, usually tends to rise and is considered a safe haven for investors during turbulent times. Stocks and shares rise in prosperous economic times. Gold rises in times of economic uncertainty. The values of collectable coins have historically been robust in both of these environments and we have watched with interest a number of large coin auctions which have taken place since the beginning of the Coronavirus pandemic. All have achieved strong prices and help to provide confidence in the wider coin market.

How do these different situations affect the prices of rare and collectable coins?

Across the board, prices of collectable coins have steadily increased since the early 2000s with some areas in particular performing extremely well. Even during the financial crisis of 2008/9 values did not waver and in the aftermath, the prices of many tangible assets, including coins, continued to climb. More recently, in the last two years we have seen world records set for several British coins, a sure sign of a buoyant market.

2019: A 1703 Vigo Queen Anne Five Guinea Piece sold for more than $1,000,000 in the New York Baldwin’s auction, making it the most valuable British coin to sell at auction.

2020: Earlier this year a 1937 Edward VIII sovereign sold privately for £1,000,000, making it the most expensive single British coin ever sold. This same coin sold in a Baldwin’s auction in 2014 for a total of £533,200. An impressive gain in just 6 years.

Why are rare, collectable coins so popular and what has historically attracted investors into this market?

Rare and collectable coins are easily storable and transportable, tangible assets. However their appeal goes far beyond the purely practical.

As well as being struck in precious metals such as gold, silver, palladium and even platinum, their designs are often works of art in their own right and typically far more elaborate than we normally see today. Add to this their rarity and the stories behind many of them and it is easy to see why they hold such broad appeal.

It is also important not to overlook the historical importance of coins. Great Roman emperors, among others,placed their portraits on coins to show their power and importance. Caesar was the first to do so and it is suggested that this decision was a contributing factor in the decision to assassinate him.A few hundred years later, during the English Civil War, coins were cut out of silver plate and cups to pay besieged troops fighting for King Charles I.

Key characteristics of coins that have risen in value the most over the last 20 years.

All of the coins that have risen in value the most over the last twenty years have three features in common; condition, rarity and popularity.

Condition is always paramount. It is a feature of human nature that we seek to acquire the best example of anything possible. This holds true with coins, and examples in superb “top” condition have always carried a premium.

Rarity has always propelled prices, the rarer an item – the less readily available it is, and the fewer opportunities a collector/investor will have to acquire an example. When a rare item does come onto the market there will usually be a rush of interest, which tends to drive the price higher. Unique examples are the pinnacle of coin collecting, and there is a certain satisfaction in knowing that no one else in the world has an item that you possess.

Increases in popularity and the resultant impact on price can come from any number of different sources. In recent times we have seen the significant increases in high grade, gold proof Five Pound and Five Guinea pieces. These items became very popular in the Asian markets in the wake of the financial crisis, thus driving the prices up and positioning them out of reach of most collectors. Popularity can also be relevant to well-known historical figures and historical events – Alexander the Great, Julius Caesar, the Spanish Armada, the English Civil war and the Great Fire of London have all become particularly popular over time showing just how important the historical aspects of certain coins are, and highlighting the stories they could tell. Particularly popular designs also frequently capture the imagination, a good example being the Victoria Gothic Crown, voted one of the most beautiful British coins ever produced.

Should you invest in rare collectable coins and will they rise in value?

As with all investments, there are no guarantees and hindsight is a wonderful thing. Over the last twenty years coins have continued to rise in value despite many economic uncertainties. The majority of collectors and investors who have bought regularly, and from reliable sources, in that time period will have seen increases in their rare coin values. We see no reason why this trend should not continue for many years to come.

At Baldwin’s, we have many decades of experience and while it doesn’t give us the omnipotence to guarantee that values will go up, we will always explain and justify why we think a certain coin is good value.

For example, we currently have for sale an extremely rare 1834 William IV Crown. The condition is superb, making it one of the finest known. There are less than 10 known examples and, as a denomination, crowns are consistently very popular with collectors and investors alike.

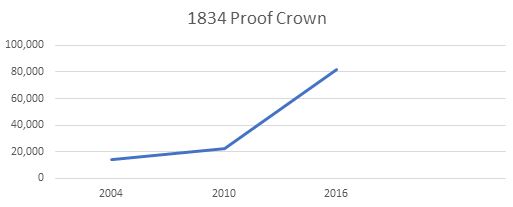

The graph below shows the price, at auction, of 3 similar 1834 Proof crowns sold in 2004, 2010 and 2016. The example we have for sale is priced at over £10,000 less than the one that sold in 2016 for £82,000, while not being hugely dissimilar in terms of quality and condition.

The graph above shows the price at auction of 3 similar 1834 Proof crowns in 2004, 2010 and 2016. Thereby making the example we have for sale very good value at over £10,000 less than the example that sold in 2016 for £82,000.

For any enquiries regarding coins either as a collector or from an investment perspective, please email neil@baldwin.co.uk